The coronavirus pandemic has brought the global aviation industry to its knees. The post-corona period is predicted to have an impact that is even worse than 9/11 and the 2008 financial crisis. As far as the aircraft manufacturers are concerned, the near future seems bleak. Due to the subdued demand for air travel, it is inevitable that this domino effect is going to hurt the aircraft manufacturing business. However in this world of 'survival of the fittest', the question remains: Which manufacturer will come out on the top?

Fight for survival

Airbus and Boeing are the two most prominent aircraft manufacturers in the world. Together, they command almost 99% of the market share in aircraft deliveries, a complete duopoly. However, in tough times like these, past experiences and market analysis can help us predict which one of them will come out on top.

Currently, Boeing has completely suspended the majority of its manufacturing and assembly plants. Airbus had taken a similar decision, but it recently restarted some of its production in Spain and France. Due to massive financial losses incurred by airlines, cancellation of aircraft orders or delayed delivery of new planes holds a high probability. Aircraft manufacturers have to be aware of these circumstances and take decisions accordingly.

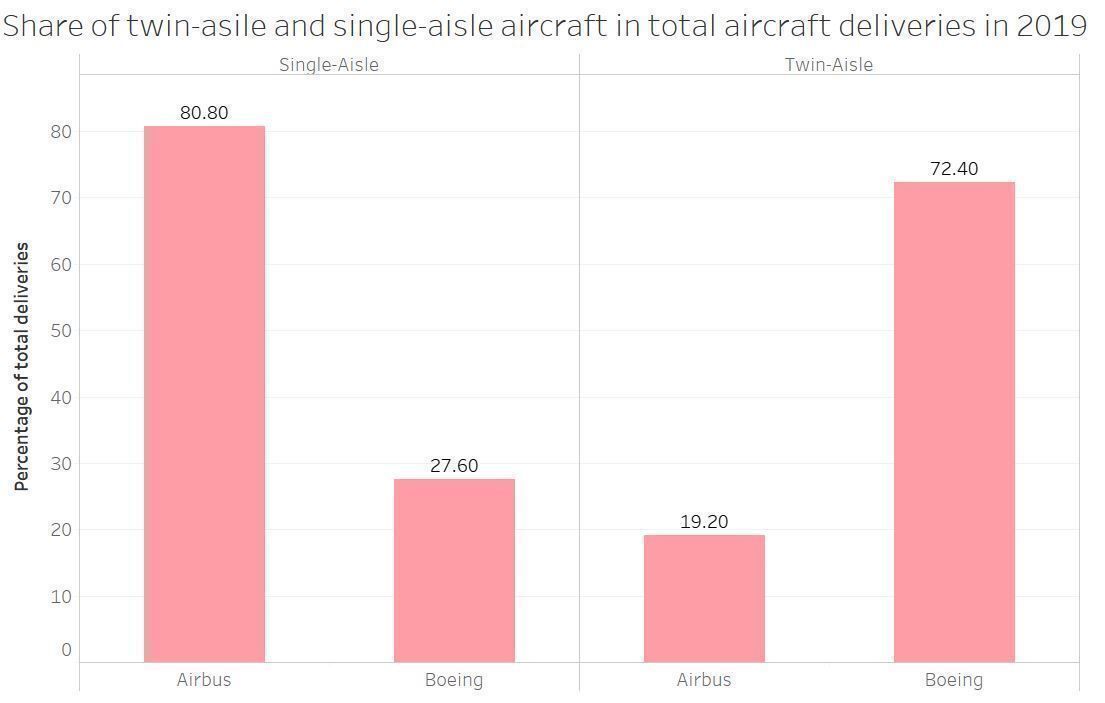

The repercussions of COVID-19 might be so great that the post-coronavirus aviation industry faces unprecedented challenges and changing market dynamics. One of the main factors of the post-corona period will be a subdued demand for air travel. It is apparent that the demand for single-aisle aircraft will be higher than that of a twin-aisle aircraft.

The above graph represents Airbus' domination in the narrowbody market. Quite predictably, Airbus will be a better-suited manufacturer to the post-coronavirus demand. On the other hand, Boeing will face serious implications due to its dependence on widebody orders.

Out of the 27.6% of its narrowbody deliveries, 67.2% were the 737 MAX. Now that the MAX is grounded, it can be concluded that, in 2019, only 9% of Boeing's total deliveries were of 737s.

With the arrival of Airbus' A320neo and A321XLR, Boeing's dependence on its outdated 737 variants might not be enough. For now, the only hope of survival is, therefore, the recertification of its narrowbody 737 MAX.

Learning from the past

According to Aerospace-Technology, post-9/11 and post-2008 crisis periods were plagued by a similar plummeting demand for air travel. In both cases, an expected trend was observed:

"The market value of single-aisle aircraft declined by approximately 15% and took two years before recovery began. For twin-aisle aircraft, however, the market value declined by approximately 20% and took 2.5 years before recovery began."

This is an analogy to the current situation in the Middle East. Although the number of COVID-19 cases there is not even close to what it is in the US or Europe, airlines in the Middle East are struggling to operate.

Emirates, which operates an entirely widebody fleet, has fully paused its operations. Qatar Airways is operating its widebodies mostly empty. Hence, any kind of dependence on twin-aisle aircraft is bound to suffer.

To conclude, the COVID-19 crisis has given this rivalry a new dimension. As far as the near future is concerned, Airbus evidently has an edge over Boeing.

Do you agree? Will Airbus win in the post-coronavirus aviation world? Let us know your thoughts in the comments.