The US Department of Transportation plans to award 16 peak-time Newark slots – good for eight roundtrips each day – to a low-cost or ultra-low-cost carrier. The purpose: to increase competition and to lower fares at the capacity-constrained airport. We check it out.

Why 16 slots?

In 2010, Southwest was awarded 36 slots at Newark as a condition of the merger between United and Continental. When it stopped serving the airport in November 2019 to consolidate at LaGuardia, it gave up its slots. While 20 off-peak slots were reallocated to other airlines, the remaining 16 peak-time slots weren't. The reason: to cut congestion and delays.

This resulted in a challenge by Spirit because the impact on competition hadn't been considered. And now it's very likely that JetBlue or Spirit – both of which have proliferated at Newark in recent years – will be awarded them, but we'll have to wait and see.

Newark isn't slot-controlled, but...

It's important to remember that while Newark is no longer slot-controlled, it remains schedule-facilitated to ensure efficient airspace and ground infrastructure use. It is a 'level two' facilitated airport, which means the airport has the potential for congestion at particular times of the day.

After all, the airport – the nation's 14th-largest this year, OAG shows – can be bustling during the afternoon and evening, when congestion and delays can mount. Because of this, the Federal Aviation Administration must approve schedules to reduce the likelihood of problems.

Stay aware: Sign up for my weekly new routes newsletter.

It has been suggested that if a Newark route with one operator welcomes a second, average fares on that route may decline by up to 45%. In reality, it's more likely that a larger market, with already more than one operator, will benefit from the reallocated slots.

JetBlue cements position as #2 at Newark

With 24 million seats at Newark this year, United is very comfortably the airport's leading operator. It has a 60.7% share of capacity. While a lot, Newark isn't a fortress hub, which is where seats from one carrier total 70%+ of the total. (Houston and Dulles are fortress hubs, though.)

Having started at the New Jersey airport in 2005, JetBlue grew modestly each year – until now. In 2021 it has 5.1 million seats there, virtually double what it had in 2019. This resulted from its network growing fourfold from 10 routes to 39, OAG indicates, with a significant focus on leisure and visiting friends and relatives travel to the Caribbean (from four routes to 16).

While JetBlue has been Newark's second-largest airline since 2017, the growth has cemented its position, aided by (temporary) cuts from United and others. JetBlue's share has more than doubled from 5% in 2019 to 12.9% now.

- United: 60.7% share of Newark's 2021 seats

- JetBlue: 12.9%

- Spirit: 5.7%

- American: 5.2%

- Delta: 4.2%

- Frontier: 2.3%

- Alaska: 1.6%

- Air Canada: 1.0%

- Lufthansa: 0.8%

- SAS: 0.8%

Low-cost carriers are up strongly at Newark

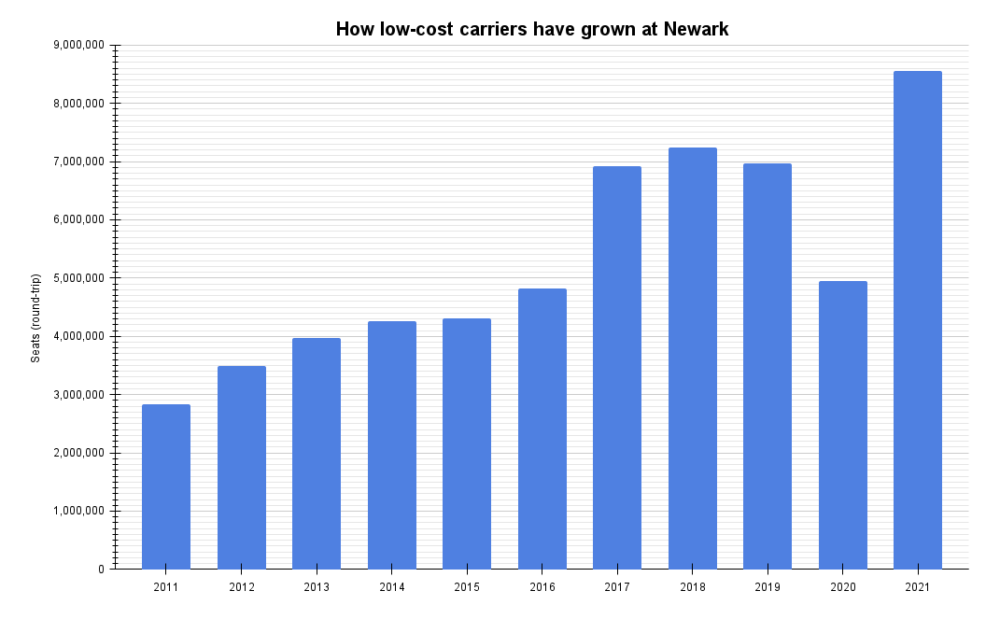

LCCs have grown by over 200% at the New Jersey airport between 2011 and 2021, analyzing schedules provided to OAG reveals. And capacity by them has risen by nearly one-quarter versus 2019, while non-LCCs are down by a sizeable 37%.

These changes mean Newark's share of LCC seats is now at 22%, up by ten percentage points in two years and against from just 6% in 2011. Of course, it'll start to reduce as non-LCCs recover, but it'll still be at the highest level ever.

Considerable growth – but why?

The figure above shows a significant rise in 2017, mainly from Spirit's first full year, along with good growth from Allegiant and JetBlue and the entry of Norwegian. While 2019 reduced from Southwest's cuts and eventual exit, the increase in 2021 is from JetBlue and, to a lower degree, Frontier (+780,000 seats added versus 2019) and Spirit (+480,000). Big changes.

Which airline do you think should get the slots? Let us know in the comments.