Embraer is a dominant force in the regional jet market, with its new E2s rapidly building on the success of its original E-Jets. So why is the world’s third-largest planemaker seeking to diversify its product offering by bringing back the turboprop, a market it left behind two decades ago? Simple Flying spoke to Embraer’s VP of Marketing and Strategy, Rodrigo Silva e Souza, to find out.

A gap in the market

Despite the favorable efficiency of the turboprop on short sectors, and its natural ability to take off and land from the more challenging airports, the market has been devoid of any new products for quite some time. DHC’s Dash 8 family hasn’t changed a great deal since its introduction in 1983, and with a dwindling backlog of orders for the type, the company has temporarily paused its production.

By far and away the winner in the modern turboprop market is ATR, with around a 75% share of the aircraft in this sector. But its products aren’t exactly cutting edge either. The ATR 42 was introduced in 1985, while the ATR 72 arrived in 1989. While both have undergone various developments over the years, the fundamental aircraft remains the same.

With ATR dominant in the market, this segment of aviation has seen a distinct lack of innovation. The turboprop’s reputation for being noisy, uncomfortable and unreliable has turned passengers off, and forced airlines to look to small regional jets as replacements. Embraer saw a huge opportunity to disrupt the market with something new, innovative, and up to date.

Stay informed: Sign up for our daily and weekly aviation news digests.

Embraer’s experience

Let’s not forget, Embraer has a strong track record in successful turboprop development. Back in the 1970s, the company brought its Bandeirante to the United States, a 19 seat turboprop that sold some 494 aircraft, much to the dismay of the incumbent manufacturers.

Fairchild Swearingen felt that the ‘Bandit’ was unfairly subsidized, and brought a complaint before the US International Trade Commission. However, the complaint was dismissed, and the EMB 110 continued its success.

In 1983, Embraer brought its larger EMB 120 Brasilia to the market. Building on the success of the Bandeirante, the 120 added new capacity for up to 30 passengers, with a range of 940 NM (1,750 km) and proved to be a hit with the blossoming commuter airlines in the United States. 354 aircraft were built, most of which were sold in the United States.

The last EMB 110 was built in 1990, and the final EMB 120 in 2001. Now, 20 years since it last built a turboprop for the commercial aviation market, Embraer is on the verge of announcing another.

When a good opportunity became a great opportunity

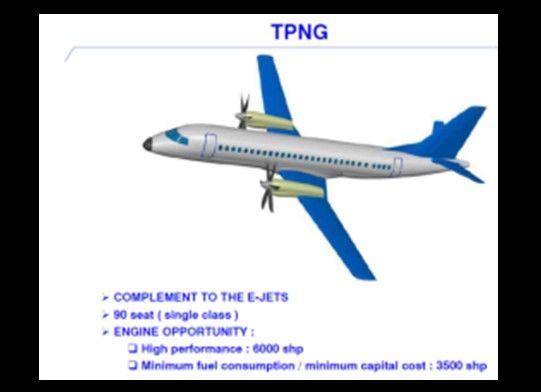

Rumors began to swirl about a new Embraer turboprop as long ago as 2016. A leaked internal diagram suggested an E-Jet-like fuselage of around 90 seat capacity. Things went a bit quiet for a few years, but it was thought that once the Boeing partnership was solidified, momentum on the project would pick up again.

When the Boeing partnership broke down, some suggested that this would be the end of the turboprop project. In fact, the then-CEO of Embraer Commercial, John Slattery, was quoted by the Wall Street Journal as saying,

“We would only really have appetite to move forward with the turboprop in the environment of the joint venture.”

But, to the industry’s surprise, the project was not off the table. In fact, the market potential for this reimagined regional aircraft has blossomed even more since it was initially conceived. Rodrigo Silva e Souza, VP of Marketing and Strategy at Embraer, explained to Simple Flying how the market in North America has evolved since the concept was first envisioned. He said,

“North America had not been a key market for this product until the beginning of this year. Of course we envisioned some market there for replacement, especially in Canada. But when we presented this product to airlines, their reaction was typically, yes, it’s a nice aircraft, the economics is great but here in the US, the traveler has a strong avoidance of turboprops, so we replaced all the turboprops by jets.”

As such, Embraer was not counting on a significant uptake from the United States market. Nevertheless, Embraer projected a global demand of 500 turboprops, more than enough to make the project worthy of investment. But earlier this year, everything changed, as Rodrigo explained,

“At the beginning of this year, two things happened. First, there was a change in the administration in the US from Trump to Biden. That really increased the importance of environmental discussions at airlines.”

The significantly better efficiency of the turboprop against a jet aircraft would give airlines an easy route to decarbonizing their operations. That makes it an attractive investment. But there is another key reason that the United States is now being seen as a viable market.

“Those regional jets with 50 seats … they don't have new generation replacement. But the smaller member of the Embraer turboprop family, the one we call the TP70, is actually an excellent aircraft configured in three classes with 50 seats.”

US airlines have been gradually winding down their use of 50 seater jets. American has gone from 251 all-economy 50 seaters in 2017 to just 122 today. Delta shrank its fleet from 149 in 2017 to 45 now, and is planning to end all CRJ flying by 2023. United is the only airline where the 50 seat share has actually grown, which is largely down to scope clause limitations.

While some airlines may look to larger regional jets to replace the 50 seat planes, some markets will still demand a smaller aircraft. The turboprop, configured in three classes, gives the airlines a route to consistent passenger experience, a right-sized fleet and a more efficient operation too. E Souza commented,

“The turboprop is an excellent tool that can replace this those 50 seater jets with better costs, better revenues, and a much better passenger experience.”

For Embraer, a good opportunity that it identified five years ago has just become an even better opportunity today. Embraer has a keen ambition to dominate the market in the sub-150-seat passenger segment, and the turboprop will provide a stepping stone to plugging the gaps in its offering.