In a previous article, we discussed how airlines will be facing a variety of challenges post-Brexit, ranging from those of the paperwork bureaucratic variety and those much more serious aviation licence issues.

But something that was only covered lightly was the effect Brexit will have on Low-Cost-Carriers (LCCs), such as Norwegian, Wizz Air, EasyJet and, of course, Ryanair, who all have many flights flying in and out of the United Kingdom (UK).

These airlines have a right to be worried, with the real possibility that they will be grounded with a hard-Brexit.

“We believe the UK government continues to under-estimate the likelihood of flight disruptions to/from the UK… …we will have no choice but to begin cancelling flights to and from the UK (and moving some or all of our UK-based aircraft to Continental Europe) from April 2019 onwards.” – Ryanair, February 2018.

How does flying currently work in the EU?

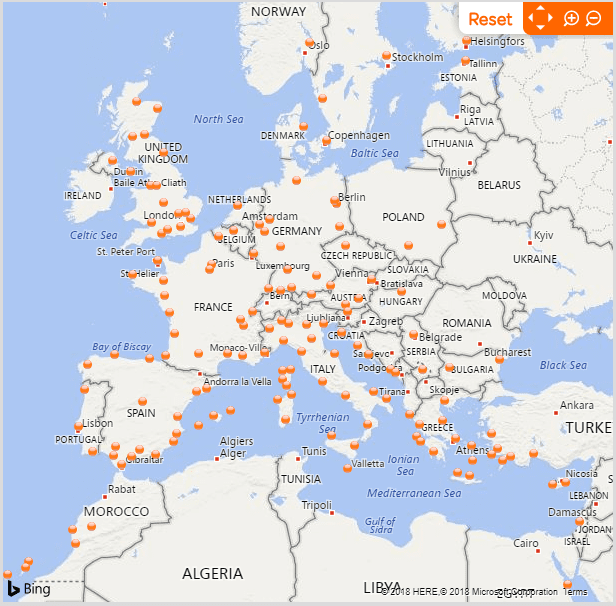

The European Union (EU) currently has a very simple system (made up of a complex network of different agencies); any airline that is based in the EU must have an EU aviation certificate, that allows them to fly to any country in the EU, and access EU aviation deals with other countries. As part of the EU, UK airlines can operate entirely EU routes, such as Paris to Berlin.

At the moment, UK aircraft and UK-made parts have EASA certification, which has recognition beyond the EU. A no-deal Brexit could see the UK tumble out of EASA jurisdiction. This would result in a calamitous standstill as UK aircraft lose foreign validation and aircraft worldwide incorporating UK-made parts enter a period of enforced grounding.

Some quick facts to keep in mind: the UK has the busiest airport system in the world, serving 360 destinations in 100 countries. Their air transport and aerospace industry is worth £22 billion to the UK economy and employs 240,000 people, as well as tourism making up 10% of the GDP.

What will happen when Brexit takes effect?

First, the UK will no longer have the right to fly to any country in the world. All of their rights have been to the bloc of the EU, not the UK as an independent country. As such they will have to renegotiate before their departure, or quickly afterwards with each country. It may actually revert to the laws that were in place before the UK joined the EU, which will involve additional fees and taxes.

This also affects the ‘open-skies’ agreement with the United States.

‘The Article 50 taskforce in the European Commission published a paper noting that, in the event of an overall ‘no deal’ scenario, it would be essential to agree a deal to ensure flights continue. This shows how important it is for both sides to ensure aviation market access continues uninterrupted. And the demands of airlines across Europe to access Heathrow means we have strong cards in our hand for the negotiations,’ – UK transport secretary Chris Grayling.

In January, the EU released a letter to all airlines with an EU licence, to clarify the rules with operating in the EU. They must be majority based in the EU, majority owned by persons or corporations in the EU (With headquarters in the EU), and that UK licences will no longer be valid to fly to the EU (and vice versa).

What does this mean for Norwegian?

This is news for Norwegian, who operates a fair chunk of its business out of Airports in the UK. Norwegian actually is made up of five different companies (linked together under parent organisation): two in Norway, one in Ireland, a new one in Argentina (and possibly Brazil) and one in the UK.

The question is what will happen with the UK company, as it will no longer be able to fly to the EU (until a deal is reached), nor will it be able to fly to any other countries until other deals are reached.

However, Norwegian is not worried, as they believe that the other areas of their business (and expansion into South America) will cover any losses or delays in service. They even go as far as to hope that the pound will fall further and allow them to operate even more cheapy.

“But we are a little bit better off than the others because we have operating licenses in the UK and outside the UK,” Norwegian CEO told journalists in Paris. “We have an EU licence, a UK licence, a Norwegian licence, so we are hedged.”

He went on to say should Brexit be devastating, they will move more flights out of Paris to destinations as opposed to London.

They do raise some concerns regarding additional fees to fly in and out of the UK, saying that it will affect their base cost for the cheapest possible fares. The Republic of Ireland, part of the EU, has abolished such fees and is a major reason why there are so many trans-Atlantic flights leaving across to America from the isle.

What about other LCCs?

Ryanair and Wizz Air can’t afford to wait for a new deal with the EU, and have applied for UK licences as well (They are primarily based in the EU), so they can retain access no matter what (Ryanair has many routes that fly within UK airspace).

Wizz Air additionally said that they are focusing on diversifying their business

“…we are confident that there remains a large addressable market in central and eastern Europe which will continue to provide opportunities for profitable growth should our UK business be adversely affected,’ – Wizz Air.

EasyJet, who is based in the UK, has gone ahead to apply for an EU licence but has stated that they will remain headquartered in the UK. This is at odds with the EU system, as written above, an airline must be majority based in the EU to have an EU licence. It is expected to cost them around £10 million to apply.

Airlines are holding their breath and await more news from the UK government, expected later this month.